the Future of the

Libyan People

For Generations to Come

Libyan Investment Authority

Was established in accordance with specific purposes and objectives from which the governance and the strategy and investment approach emanate.

Billion

Company

Real Estate

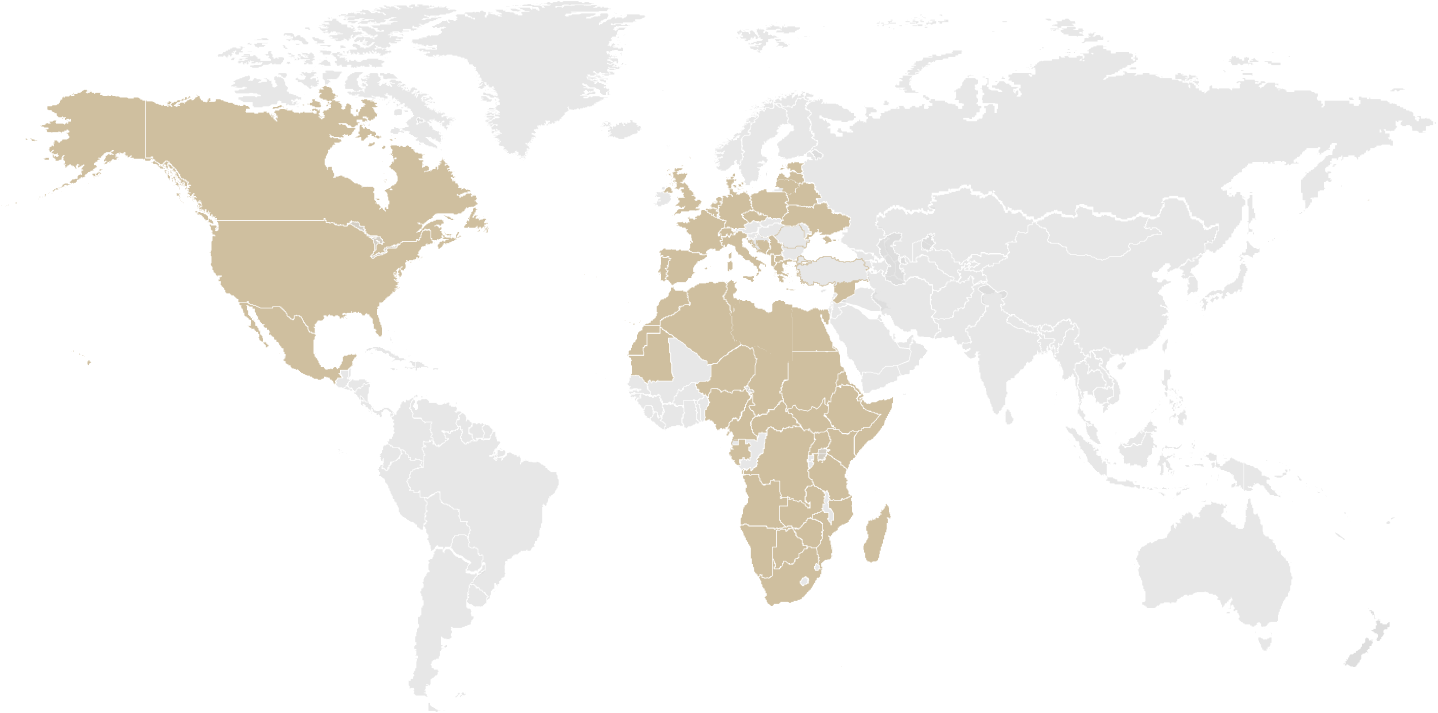

Global Geographical

Distribution of Assets

Preserving and Growing the LIA’s Assets for the Generations to Come

The assets owned directly by the LIA remain subject to the freezing measures imposed by the UN Security Council pursuant to its resolutions (1970 – 1973 – 2009) of 2011. These measures were imposed in order to preserve the assets of Libya’s sovereign wealth fund from any legal disputes at the time. However, despite the legitimacy of their initial objectives, these measures have resulted in significant challenges which impacted the LIA’s capability in achieving the ultimate returns of its frozen assets under the changes of the rapid international economic.

Guided by its unwavering commitment to preserving these assets and maintaining their value for the future generations, The LIA prioritise the freezing measures file within its transformation strategy. This was underpinned by a strictly considered vision that aims to mitigate any negative impacts of the freezing measures while building bridges of trust with the UN Panel of Experts and Security Council Committee. To achieve this vision, the LIA adheres to the transparent and trusted reports submitted to the UN Security Council Committee concerning Libya and the Council’s member states. These reports provide a detailed analysis of the negative impacts resulted on the frozen assets, while demonstrating the LIA’s commitment to the UN security Council resolutions, and its full compliance with the freezing measures.

These exerted efforts culminated the UN security Council’s resolution (2701) of 2023, which expressed the Council’s willingness to reconsider the freezing measures to address the already existing challenges. in response, the LIA initiated the development of a plan to reinvest the frozen assets; while remaining subject to the freezing measures, as a part of its commitment in safeguarding its assets and maximizing their value.

The UN Security Council has issued its resolution (2769) of 2025 as a result of the significant development that reflects the success of the LIA’s efforts, which focused primarily on preserving its assets and enhancing governance, transparency, and compliance to the Santiago principles. This resolution emphasized the importance of preserving the LIA’s assets and allowing the LIA to invest its frozen cash reserves in low-risk time deposits with selected financial institutions under the freezing measures. Additionally, it permits the reinvestment of accumulated financial returns with investment funds managers while remaining subject to the freezing measures.

Our

Transformation

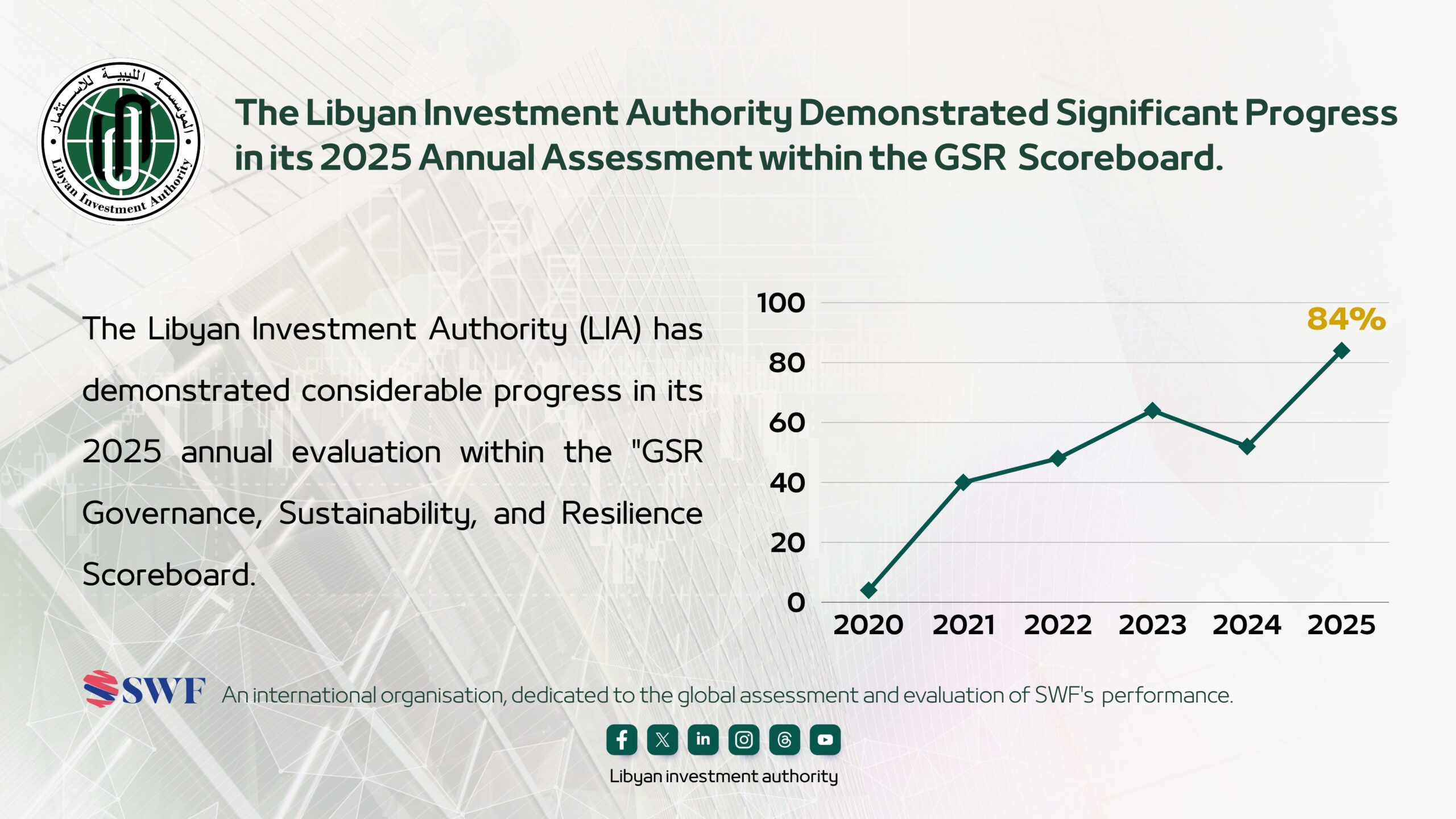

The Libyan Investment Authority (LIA) is

committed to implementing real change in

the continuous pursuit of institutional

excellence.

Our immediate priority is to drive forward

our comprehensive transformation

strategy, aimed at improving governance,

transparency and accountability across our

organisation.

This strategic initiative was launched in January 2020, to consolidate our efforts to preserve and develop the Authority’s assets for the benefit of the Libyan people and future generations.

Our Strategic Objectives

-

Strengthening Governance

Optimising the LIA’s organizational and administrative framework, ensuring adherence to principles of transparency and accountability. This includes developing labour regulations, training staff, and ensuring compliance with international standards.

-

Enhancing Transparency

Managing sovereign wealth responsibly and with complete transparency regarding financial and operational performance, based on consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS), with a focus on diversification and risk management.

-

Ensuring Asset Safeguarding

Managing assets within the freezing measures, according to a new mechanism to ensure the preservation and maximization of the value of these assets to overcome the negative impacts resulted from the implementation of the international asset freezing measures.

-

Developing Investment and Financial Performance

Diversifying the investment portfolios geographically and sectorally, focusing on high-viability sustainable investments.